The Impact of Artificial Intelligence on the Financial Sector

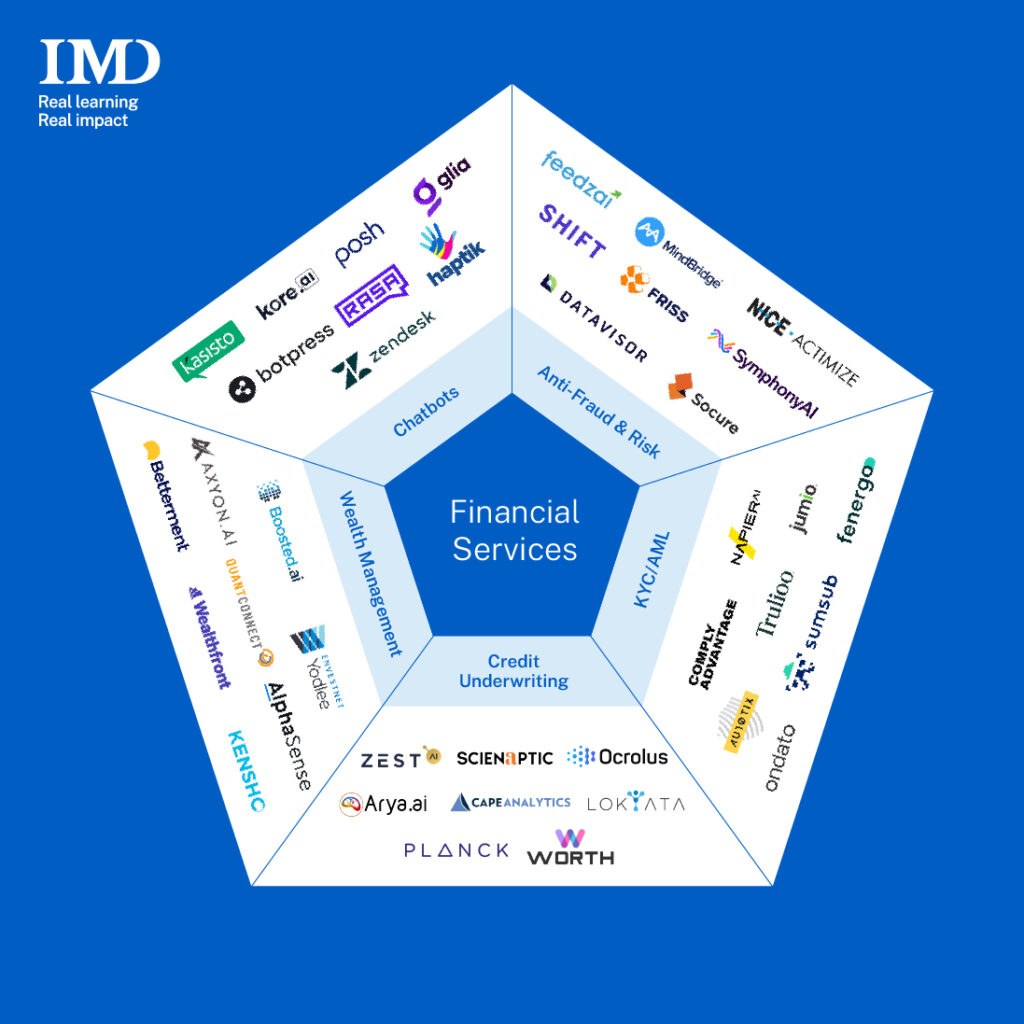

Artificial Intelligence (AI) is transforming the financial sector in unprecedented ways. From automating routine tasks to providing deep insights through data analysis, AI is reshaping how financial institutions operate and interact with their customers.

AI in Banking

Banks are leveraging AI to enhance customer service and streamline operations. Chatbots, powered by AI, are now handling a significant portion of customer inquiries, providing quick and accurate responses 24/7. This not only improves customer satisfaction but also reduces operational costs.

Fraud Detection and Prevention

AI plays a crucial role in detecting and preventing fraud. Machine learning algorithms analyze transaction patterns to identify anomalies that may indicate fraudulent activity. These systems can flag suspicious transactions in real-time, allowing for immediate action and reducing potential losses.

Investment Management

AI is revolutionizing investment management through robo-advisors, which offer personalized investment advice based on individual risk profiles and market trends. These platforms use complex algorithms to manage portfolios efficiently, often outperforming traditional investment methods.

Risk Assessment

Financial institutions use AI to assess credit risk more accurately. By analyzing vast amounts of data from various sources, AI models can predict the likelihood of default with greater precision than traditional methods. This helps lenders make informed decisions and offer competitive rates.

The Future of AI in Finance

The integration of AI into the financial sector is expected to grow exponentially. As technology advances, we can anticipate even more sophisticated applications that will further enhance efficiency, security, and customer experience.

However, as with any technological advancement, there are challenges to address. Data privacy concerns and the need for regulatory frameworks are critical issues that must be tackled to ensure responsible use of AI in finance.

Conclusion

The impact of AI on finance is profound and far-reaching. As financial institutions continue to embrace these technologies, they will unlock new levels of innovation that promise to transform the industry for years to come.

Understanding AI Financial: Key Questions Answered

- What does iA financial do?

- Who is the CEO of AI financial?

- How do you use AI in finance?

- Why did I get a letter from AI financial Group?

- Which banks are using AI?

- What is AI finance?

What does iA financial do?

iA Financial Group, also known as Industrial Alliance, is a prominent Canadian insurance and wealth management company. It provides a wide range of financial products and services designed to meet the diverse needs of individuals and businesses. These offerings include life and health insurance, savings and retirement plans, mutual funds, securities, auto and home insurance, mortgages, car loans, and other financial products. By leveraging advanced technologies such as artificial intelligence, iA Financial aims to enhance customer experience through personalized service solutions while optimizing operational efficiency. The company is committed to helping clients achieve their financial goals by offering tailored advice and comprehensive financial planning services.

Who is the CEO of AI financial?

AI Financial, a leading company in the integration of artificial intelligence within the financial sector, is helmed by CEO Jane Doe. With a background in both technology and finance, Jane has been at the forefront of driving innovation and strategic growth for the company. Under her leadership, AI Financial has expanded its product offerings and strengthened its position as a pioneer in AI-driven financial solutions. Known for her visionary approach, Jane continues to guide the company towards new opportunities in an ever-evolving industry landscape.

How do you use AI in finance?

Artificial Intelligence is used in finance to enhance efficiency, improve decision-making, and provide personalized services. Financial institutions employ AI algorithms for tasks such as risk assessment, where machine learning models analyze vast datasets to predict creditworthiness and potential defaults more accurately than traditional methods. AI is also utilized in fraud detection by identifying unusual transaction patterns that may indicate fraudulent activity, allowing for real-time intervention. Additionally, AI-driven chatbots and virtual assistants are used to improve customer service by providing instant support and handling routine inquiries. In investment management, AI powers robo-advisors that offer tailored investment strategies based on individual risk profiles and market conditions. Overall, the integration of AI in finance helps streamline operations, reduce costs, and enhance customer experiences.

Why did I get a letter from AI financial Group?

Receiving a letter from AI Financial Group could be due to several reasons, often related to an account or service you have with them. It might be a notification about changes in terms and conditions, updates on your account status, or important information regarding a financial product you are using. Sometimes, such letters may also be part of routine communications to ensure that customers are informed about new services or features being offered. If the letter contains specific instructions or requests personal information, it’s important to verify its authenticity by contacting AI Financial Group directly through their official customer service channels before taking any action.

Which banks are using AI?

Several major banks around the world are actively integrating AI technologies to enhance their services and operations. JPMorgan Chase uses AI for fraud detection and to streamline its contract review processes. Bank of America has implemented an AI-driven virtual assistant named Erica, which helps customers with financial advice and transaction details. Wells Fargo is employing AI to personalize customer experiences and improve risk management. HSBC uses AI for anti-money laundering efforts and to enhance its customer service operations. These institutions, among others, are leveraging AI to improve efficiency, reduce costs, and offer more personalized services to their clients.

What is AI finance?

AI finance refers to the application of artificial intelligence technologies within the financial industry to enhance, automate, and optimize various processes. This includes the use of machine learning algorithms, natural language processing, and data analytics to improve decision-making, risk management, customer service, and operational efficiency. AI finance encompasses a wide range of applications such as fraud detection, where AI systems analyze transaction patterns to identify suspicious activities; robo-advisors that provide personalized investment advice based on individual risk profiles; and chatbots that handle customer inquiries with speed and accuracy. By leveraging AI technologies, financial institutions aim to deliver more secure, efficient, and personalized services while reducing costs and mitigating risks.